Lucrative

Quick to access and simple to use, wherever you are. One document is all that's needed

Quick to access and simple to use, wherever you are. One document is all that's needed

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

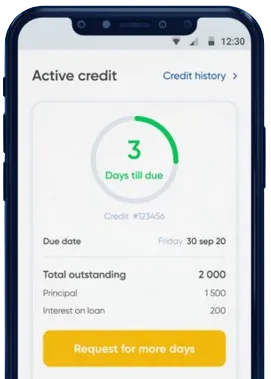

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Initiate your application on our app by completing the required form.

Wait for our quick decision, which takes only 15 minutes.

Have the money transferred to you, usually within one minute.

Initiate your application on our app by completing the required form.

Download loan app

If you are in need of a small amount of money to cover unexpected expenses or emergencies, fast loans in Kenya can be a great option. These loans are convenient and quick to access, providing financial relief when you need it most.

One of the main benefits of mini loans is their accessibility. Many lenders in Kenya offer mini loans with minimal requirements, making it easier for individuals to qualify. This means that even people with a less-than-perfect credit score can still apply and get approved for a mini loan.

Fast loans in Kenya can be useful for a variety of purposes. Whether you need to cover medical expenses, repair your car, or pay for unexpected bills, a mini loan can provide the necessary funds quickly.

Mini loans are also useful for those who need a small amount of money for a short period of time. These loans typically have a shorter repayment period, making them ideal for those who need temporary financial assistance.

With fast loans in Kenya, you can access the funds you need in as little as 24 hours, making it a quick and convenient option for financial emergencies.

While mini loans in Kenya are generally easy to access, there are still some requirements that borrowers need to meet. Typically, lenders will require proof of identification, proof of income, and a bank account for the funds to be deposited into.

Additionally, some lenders may require a minimum credit score or a guarantor for the loan. It is important to check the specific requirements of each lender before applying for a mini loan.

If you are in need of a small amount of money for a short period of time, fast loans in Kenya can be a great option. These loans are quick and easy to access, making them ideal for financial emergencies.

In conclusion, fast loans in Kenya provide a convenient and accessible option for those in need of quick financial assistance. With minimal requirements and quick access to funds, these loans can be a lifesaver in times of need.

Yes, you can apply for fast loans in Kenya. Many financial institutions and online lenders offer this type of loan for individuals in need of quick cash.

Typically, to qualify for fast loans in Kenya, you need to be a Kenyan citizen or resident, have a steady source of income, and be over 18 years old. Lenders may also require you to have a good credit score.

Approval time for fast loans in Kenya can vary depending on the lender. Some online lenders offer instant approval, while traditional banks may take a few days to process your application.

Interest rates for mini loans in Kenya can vary depending on the lender and your creditworthiness. On average, interest rates for small loans range from 10% to 30% per annum.

Repayment periods for mini loans in Kenya vary from lender to lender. Typically, you can expect to repay a 10,000 loan within 1 to 12 months. Some lenders may offer flexible repayment terms.

If you are unable to repay your mini loan on time, you may incur late fees or penalties from the lender. Your credit score could also be negatively affected, making it harder for you to borrow in the future. It's important to communicate with the lender if you are facing repayment difficulties.