BetLion – Start Your Winning Journey in Kenya

Want to start winning right now? Then it’s worth taking a look at BetLion — or, as it’s also known, Bet Lion. This is a popular platform for online betting that’s perfectly suited for players from Kenya. It offers not only sports betting but also a large casino section with over 700 games from top providers. Players can enjoy slots, roulette, live games, and jackpots.

Special attention should be paid to the Betlion daily jackpot — one of the biggest daily jackpots in the region. The reward pool can climb over 1,000,000 KES. It’s a real chance for Kenyan players to hit it big just by predicting football match results.

The casino is 100% legal in Kenya. It has a real license from the Betting Control and Licensing Board of Kenya (BCLB) — license number 000180. That means the games are safe, fair, and not a scam. You don’t need to worry about losing your money. The website works well with M-Pesa, so you can send and get money easily using your phone.

Why BetLion Stands Out in Kenya

The BetLion Kenya platform is already well known among bettors, and for good reason. This is not just another betting site. It’s a full entertainment hub made especially for Kenyan players. But what makes it stand out?

First of all, Bet Lion has an official license. That means your money, winnings, and personal details are safe. You don’t need to worry about scams or delays in withdrawals — the platform keeps everything secure and fair.

Secondly, the platform is made for locals. The design is very easy to use, even if your English is not strong. It works smoothly on all devices, even on phones with slow internet or low memory.

One of the best things is the Betlion daily jackpot. These are daily football jackpots where you can win a big prize just by predicting match results. Even if you don’t get all the predictions right, the platform gives small payouts for part of the correct picks, too.

The site also supports fast registration, one-click betting, and quick payments using mobile money services like M-Pesa and Airtel Money.

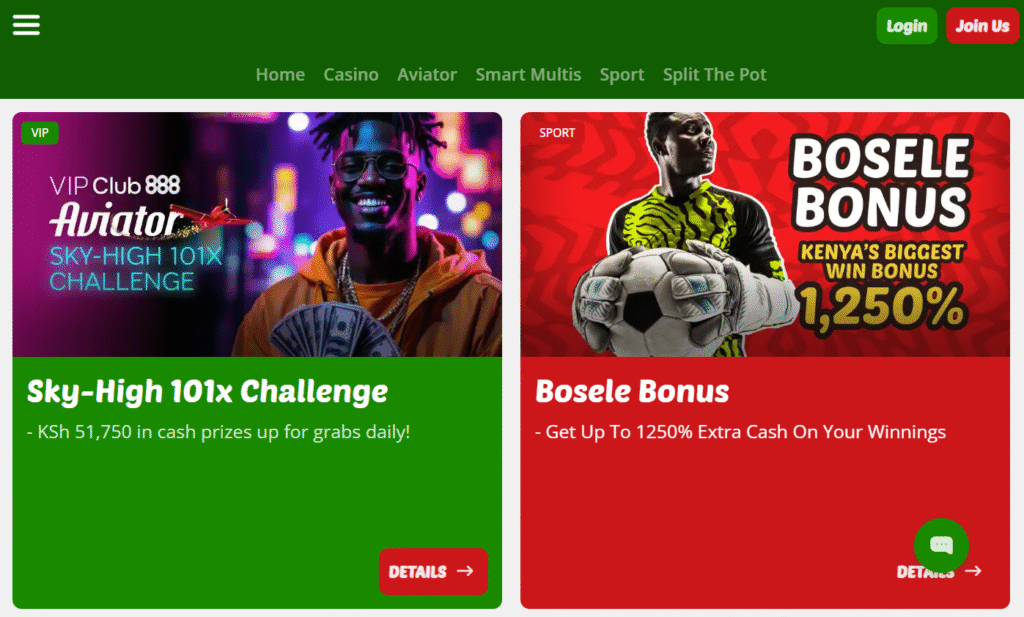

Exciting Bonuses at BetLion

Everyone loves bonuses, and BetLion Kenya has something great for you! You don’t need to be a pro to enjoy them. The platform gives cool rewards to both new users and people who play often.

There are promotions all the time — for football games, holidays, or just for being active. You can get free bets, cashback, or even tickets for the daily jackpot. You don’t need to do anything special — just play, and the bonus will come to you.

Where can you find the bonuses? It’s super easy. On the homepage, you’ll see bright banners — just tap the one you like. Or go to the “Promotions” section in the menu to see all the offers.

BetLion casino makes betting more fun — it’s not just about placing bets, it’s also about getting extra rewards.

Welcome Bonus Details

After you register on Bet Lion Kenya, you will get a nice welcome bonus — a risk-free bet. If your initial wager doesn’t win, the site will refund you with a Free Bet equal to the stake, up to 100 KES.

This bonus is easy to get. Here is how to get the LionBet welcome bonus:

- Create an account on the BetLion website — it takes only a few minutes.

- Deposit at least 50 KES using M-Pesa.

- Place your first bet of at least 20 KES with odds of 2.0 or higher. This can be a single or multiple (combo) bet.

- If your wager is unsuccessful, the casino will award you a Free Bet worth up to 100 KES by 4:00 PM the next day.

- Use your Free Bet within 7 days — and try your luck again!

Important: Jackpot and Virtual bets do not count for this bonus. And if your bet wins, you just enjoy your profit — no Free Bet is given because you already won.

This bonus is a great way to start betting without risk. And the platform often has more promotions. Just look at the banners on the homepage or open the “Promotions” section — there’s always something new waiting for you!

VIP Program Benefits

LionBet cares about its regular players. If you regularly gamble, deposit money, and maintain long-term activity, you have a good chance of getting invited to the closed VIP club.

In the VIP club, you will find many nice bonuses: weekly cashback (getting back part of your lost money), higher withdrawal limits, a personal manager, free bets, and invitations to special tournaments. The higher your VIP level, the better the gifts. For example, Platinum-level players can get free bets up to 10,000 KES and up to 10% cashback every week.

Bet Lion has several VIP levels — from Bronze to Platinum. Getting into the program is easy. You just need to play regularly: place bets, add funds to your account, and do not leave your account inactive for a long time. The system automatically counts your activity. If the total amount of your deposits and bets is enough, a manager will contact you, explain the conditions, and give you VIP status.

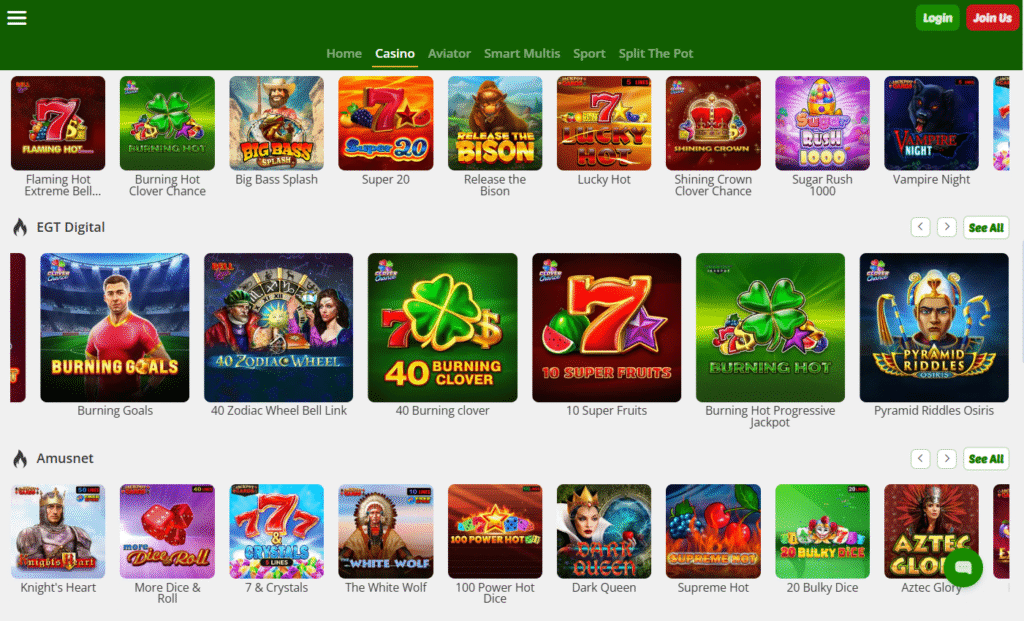

BetLion Casino: Top Games Await

If sports betting is not your thing, or you want to add some variety to your play, then the BetLion Casino section is just for you. Here you can find hundreds of casino games from leading providers that will keep you entertained.

Players have access to classic Betlion slots, the latest slot machines with special effects, table games, and also realistic live games. All games are certified, operate fairly, and give a chance to win real money.

Slots and Jackpots

The most favorite games in any online casino are slot games. And BetLion offers a wide selection of the most popular slots that players in Kenya have long loved.

Here are some of the slots most often chosen:

- Sweet Bonanza — a bright fruit slot with colorful symbols and multipliers up to x100.

- Gates of Olympus — a slot with an ancient Greek gods theme and random bonuses.

- The Dog House — a fun game with cute dogs and sticky wilds.

- Aztec Gems — a simple but exciting slot with a jackpot.

- Big Bass Bonanza — a favorite fishing-themed slot with free spins.

- Starlight Princess — a cartoon-style slot with huge win boosters.

- Fruit Party — another classic fruit hit with cluster wins.

- Book of Dead — a legendary slot about adventures in Egypt.

- Wolf Gold — a slot with a progressive jackpot and Money Respin feature.

- Hot Hot Fruit — a simple, hot slot with nice design and instant wins.

The site also has games with the BetLion Jackpot — these are special machines where the total prize pool grows with every player’s bet. Jackpots can reach very large amounts — sometimes over 1,000,000 KES! And the main thing, the win can happen anytime, even with a minimum bet.

Most slots in Lion Bet Casino support autoplay, have a demo mode, and work great on smartphones. You can play right from the browser — no downloads needed.

Live Casino Thrills

Want to feel the vibe of a real casino without leaving home? On BetLion Kenya, there’s a live betting section where games are streamed in real time. Real hosts deal the cards, spin the roulette wheel, and interact with players during the game. You see everything happening live and place your bets instantly.

Check out these top live games you can play:

- Live Roulette – classic casino action: spin the wheel and bet on a color or number.

- Blackjack – try to get 21 and beat the dealer.

- Baccarat – a simple, fast-paced game with big winning chances.

- Teen Patti – an Indian-style card game that’s very popular among players.

- Andar Bahar – another easy card game with instant results.

- Game Shows – fun, interactive games like Mega Wheel or Sweet Bonanza Live.

- Dragon Tiger – a fast and fun game where you pick a card and place your bet on it.

The games come from top providers like Evolution, Ezugi, and Pragmatic Play Live. That means the streams are always high quality, and the hosts are friendly and professional. You can play from your phone or laptop, enjoy easy and affordable bets, and experience real casino excitement all in one place — only at BetLion.

Safe and Fast Banking Options

At BetLion Kenya, adding money and withdrawing your winnings is really easy. The platform uses a secure platform to keep your personal info and cash safe. Everything is built for players in Kenya, with M‑Pesa and Airtel Money working smoothly.

Payment Methods Table

| Method | Deposit Time | Withdrawal Time | Min. Deposit | Max. Withdrawal |

| M‑Pesa | Instant | Up to 24 hours | 50 KES | 140,000 KES |

| Airtel Money | Instant | Up to 24 hours | 50 KES | 140,000 KES |

To deposit money, log into your account, tap “Deposit”, choose your payment method (like M‑Pesa), type the total and approve the transaction on your mobile. The money shows up in your account right away — no waiting.

To withdraw your winnings, go to “My Account” — “Withdraw”, enter the amount (between 50 and 140,000 KES), and confirm. In most cases, you’ll get your money in minutes, but it can take up to one day.

You can always check your full bet and transaction history in your account, under the “BetLion My Bets” section. There, you’ll see your current bets, past results, jackpot entries, and more.

Reliable Customer Support

No matter if you are new or already know how to play, sometimes you need help. Maybe you don’t understand how to place a bet, can’t find your bonus, or have a problem with deposit or withdrawal.

BetLion is always ready to support you. The team is friendly and answers fast.

Support works every day, also on weekends and holidays. You can ask questions in English and don’t have to wait long.

How to contact Bet Lion Kenya:

- Email: support@betlion.com

- WhatsApp: chat with support team

- Live chat: on the casino website — always open (24/7)

- Social media: Facebook and Twitter — send message (DM)

Usually, they answer in 15–30 minutes. The fastest ways are live chat and WhatsApp.

What Players Say About BetLion

Real player reviews are the best way to understand how the platform works for everyday users. We’ve gathered a few thoughts from Kenyan players who use BetLion regularly. They share what works, what they enjoy, and why they keep coming back.

Brian Mwaura:

“Aki, I only joined this platform to try that daily jackpot thing… tell me why now I’m checking scores like I’m a real coach. The way I almost won 800K, I even refused to eat that day. But honestly, the site is smooth, M-Pesa is fast, and the games? Wueh! Sweet Bonanza is my stress relief. I spin and just vibe. BetLion is now my toxic bestie.”

Sharon Achieng:

“I came for the free bet, I stayed for the drama. One minute I’m placing a 20 bob bet, next thing I’m shouting at my phone ‘GIVE ME JACKPOT!’ The live games feel like I’m in Vegas, just without the flight. And these slots? Addictive! M-Pesa gives my cash back so fast, even my landlord doesn’t move that quick!”

Kevin Otieno:

“Let me tell you… Bet Lion Kenya had me screaming at my TV like I’m the coach. I missed the jackpot by ONE game. Just one! But it’s okay — I still got something small. Also, I love how the site doesn’t stress you. Just log in, place bet, boom. If you lose, try again. If you win, call everyone and buy lunch.”

This is an easy-to-use, trustworthy, and profitable site for sports betting and online casino entertainment. It’s designed specifically for players in Kenya: straightforward, localized, offering attractive jackpots and honest payouts.

Frequently Asked Questions

Is BetLion Safe and Legal in Kenya?

Yes, LionBet operates legally in Kenya. They have an official license from the government. This means they follow all the rules. Your money and data are safe. The site is secure, and payments are always fair. If you have any questions, you can contact support. They will help quickly. So, the platform is a safe place for betting.

How to Check BetLion My Bets?

To check your bets, log in to your Lion Bet account on the website or app. Then open the menu and click on “My Bets.” You’ll see all your active and past bets, as well as jackpot results.

How to Play BetLion Jackpot?

Go to the “Betlion Jackpot” section on the site. Choose the winners of the football matches and place your bet. If you guess all results right — you win the jackpot, and if you get some right — you still get a smaller prize.